As we have reported previously, Africa’s technology start-ups experienced a record year in 2021. Cashing in big increases in both deal volume and the number of funding rounds. But has this success been mirrored across all funding stages? And what can early-stage founders learn from the success of later-stage technology companies that hit the headlines?

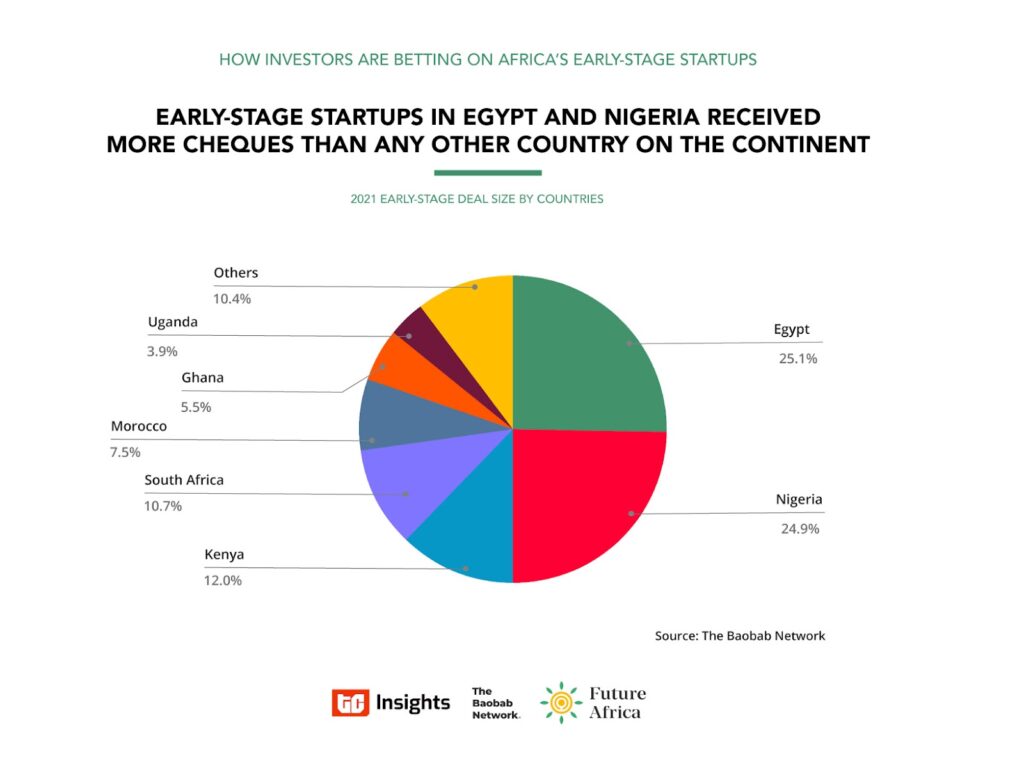

With Egypt and Nigeria leading the way in early-stage funding in 2021, start-ups in Morocco, Ghana and Uganda also closed a number of early-stage funding rounds. We also saw significant growth in sectors such as e-commerce and online retail. But has growth been consistent across all sectors?